Over the past few years, we have witnessed a quiet but decisive shift among unlisted companies in India when it comes to managing their equity compensation strategies. As the adoption of Employee Stock Option Plans (ESOPs) deepens across sectors, companies are no longer just viewing them as a tool for retention or wealth creation. Instead, they are strategically aligning ESOP design with cap table hygiene, governance, and future fundraising readiness. And at the heart of this evolution is the increasing reliance on Employee Welfare Trusts.

Let’s talk about the real issue many unlisted companies face today: a cluttered cap table. When companies directly allot shares to employees post-ESOP exercise, they often end up with a long list of individual shareholders. This can create administrative complexity, legal compliance challenges, and in some cases, become a barrier during funding rounds or IPO preparations.

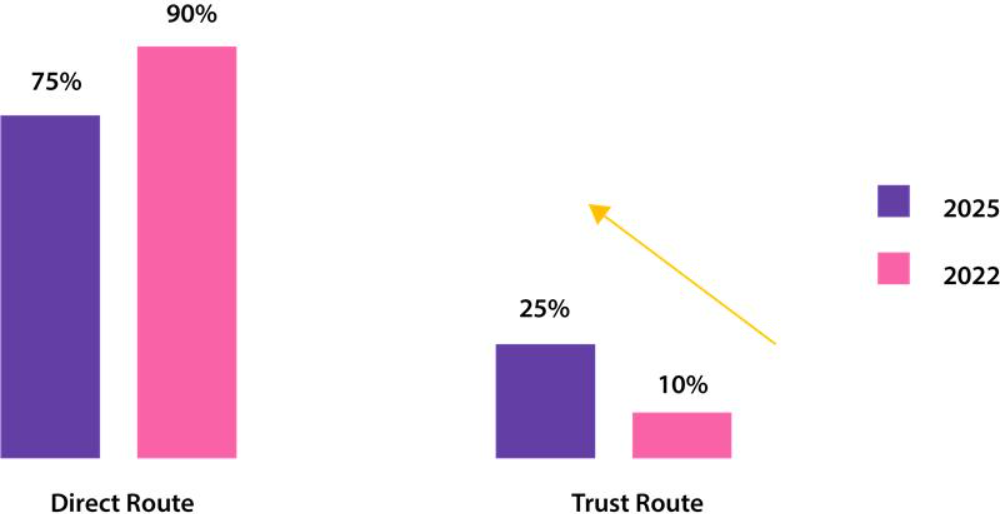

According to the 2025 Equity Compensation Trends Report, 25% of unlisted companies have already adopted the Trust route, a significant jump from just 10% in 2022. This shift marks a clear strategic pivot.

It’s not just about compliance, Companies are seeing real strategic value:

From a legal perspective, the distinction between Legal and Beneficial ownership is key. Employees may not hold shares directly in their name, but they enjoy all rights to value and upside through their beneficial interest. As per the Companies Act, declarations via different forms help establish this dual ownership transparently and legally.

At Qapita, we find this shift very encouraging. It signals that companies are not just adopting ESOPs for the sake of it, but are thinking long-term about how to structure these plans effectively. Trusts allow companies to offer ownership without giving away control, a balance that’s vital in the early and growth stages of a business.

Of course, it’s not one-size-fits-all. But if you’re an unlisted company looking to:

This structure not only solves current problems but sets the foundation for scalable, compliant, and investor-friendly equity plans. It’s no longer an emerging trend; it’s becoming a best practice.

Let’s make ESOP ownership meaningful, manageable, and modern.